Hong Kong Credit Market Growth Led by Credit Card Originations

- Credit activity grows strongly during second quarter, led by credit card originations

- Virtual banks gained the rank of leading issuer of revolving lines in Hong Kong

- Sustained demand for personal loans supported by competitive market dynamics

Credit activity in Hong Kong continues to grow strongly, with originations across major products increasing by 32% year-over-year (YoY) for Q1 20231, led by extraordinary growth in credit card originations.

This is according to global information and insights company and Hong Kong’s leading credit reference agency TransUnion’s (NYSE: TRU) Q2 2023 Industry Insights Report, which provides lenders with insights into trends driving the credit market.

Credit card originations grew most significantly, by 45% YoY, with card originations among sub-prime2 consumers growing by 391% - albeit off a low base. However, the average new card limits on these sub-prime originations are 30% lower than the average new card limit offered to consumers in this risk tier during the same quarter of 2022. The total credit limit for newly originated credit cards increased by 73% YoY during Q2 2023, with sub-prime limits having increased by 242% YoY.

Diagram 1: Credit Card Origination Growth – YoY

Source: TransUnion Hong Kong consumer credit database

These increases in originations are in a market that showed significant optimism in the context of a 2.7% GDP growth3 recorded in the first quarter of the year, subdued inflation at 1.9%4, and low unemployment at 2.9%5. Ascribing the surge in originations as local market optimism is supported by the findings of the TransUnion Hong Kong Q3 2023 Consumer Pulse Survey, in which 45% of respondents said that they were optimistic about their household finances for the next 12 months, and 35% saying that they are planning to apply for new credit or refinance existing credit within the next year. Despite the high interest rate environment, 58% said that current rates would have little or no impact on their decision on whether to apply for credit in the next year.

“Consumers are actively re-engaging with the newly re-opened economy, seeking out offers from lenders that include appealing benefits and lucrative loyalty programs,” said Marie Claire Lim Moore, Asia-Pacific regional president and Hong Kong CEO at TransUnion. “Lenders have invested heavily in promotions driving acquisition and spend, through a variety of mechanics, including reward currencies in return for choosing a particular airline or retailer.”

“Consumers are making the most of their renewed opportunities to transact with an increased confidence in Hong Kong’s economic growth – they’re travelling and shopping, and they’re actively seeking the most lucrative rewards and return on their spend while exercising their significant buying power. This is a reassuring sign for lenders and an opportunity to stay relevant and gain prominence to capture a growing share of spend amongst existing customers and prospects", she said.

Virtual banks leading market share of revolving line originations

In Q1 2023, revolving line originations grew by 15% YoY with new credit limits for this product growing at the same rate. The most significant growth in originations was observed (35%) among sub-prime consumers, who are expanding their wallet of credit products to take advantage of the additional liquidity and convenience that these products offer.

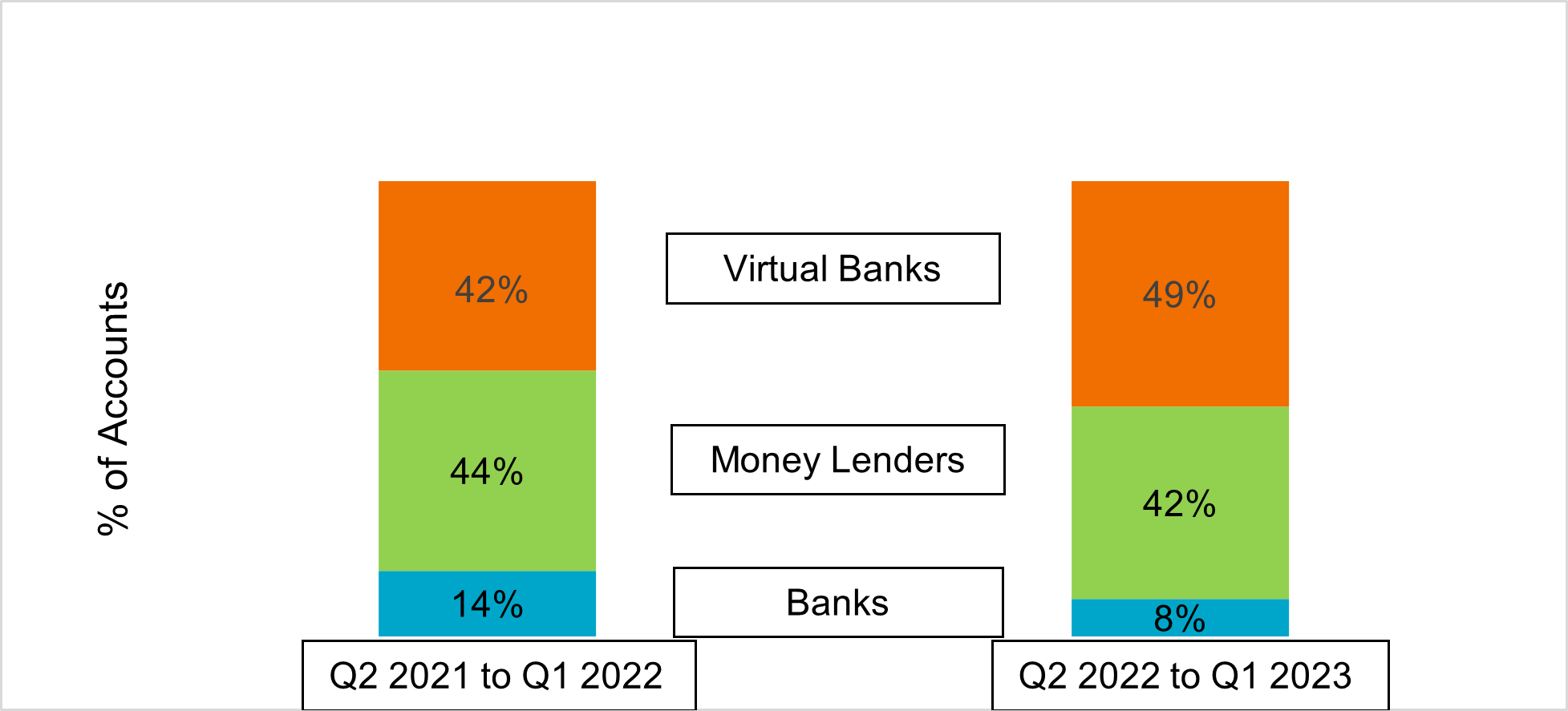

For the first time since their entry, virtual banks recorded 49% of all revolving line originations, making them the leading provider of this loan type. Virtual banks are particularly popular among younger borrowers, with these FinTech platforms designing their banking experience to be more engaging for this target segment.

Diagram: Revolving Line Origination by Lender Type

Source: TransUnion Hong Kong consumer credit database

Virtual banks are enjoying increased market share across risk tiers as they can offer almost all the banking services available at conventional banks, but via digital solutions that offer speed and convenience. They are supported by purpose-designed security mechanisms and are obliged by Hong Kong regulations to accept all interested clients without setting any minimum account balance7.

When asked whether they held any type of virtual banking products, 56% of respondents in the Q3 Consumer Pulse Survey said that they held a loan from a FinTech firm or digital bank.

“Competition is intensifying in the revolving line market. To stay competitive and capitalise on the growth in this market, lenders need to offer a friction-right verification and onboarding process for their customers, who expect fast, pleasant, and personalised experiences,” Lim Moore explained. “With two-thirds6 of respondents saying that they would switch brands for a better digital experience, FinTech platforms are well positioned to leverage consumer identity solutions that support smooth customer onboarding and retention, enabling trust between businesses and consumers.”

Demand for personal loans benefits from sustained growth

Personal loan originations grew by 5.2% YoY, with most demand in the prime and below risk tiers. Balances grew by 8% YoY and continue to stay at higher levels than pre-pandemic observations.

As seen with revolving lines, virtual banks are gaining share in this market, holding 9% of personal loan originations, compared to 7% in the same quarter in 2022. Banks’ share of this product type decreased from 44% of the market to 40% over the year, while money lenders’ share grew by three percentage points to 51%.

“Demand for personal loans continues to grow at a steady and sustained level despite the current high interest rate environment,” Lim Moore said. “Lenders are promoting attractive interest rates to stimulate demand for this product, which along with credit cards is one of the first products opened by consumers as they start their credit journey and build their risk profile.

“Even though inflation, high interest rates and other macroeconomic trends will continue to influence how consumers manage their finances for the rest of 2023, they are regaining confidence in the local economy and will likely seek out the most appealing offers from lenders as they re-engage with hospitality, retail, and travel in the coming months,” she added.”

For more information about the TransUnion Hong Kong Industry Insights Report, register for our webinar on September 19, 3pm HKT by clicking here.